HMRC’s R&D tax reforms: What businesses need to know

April is hurtling towards us, and that means HMRC’s raft of new requirements for Research & Development (R&D) tax relief claims are right around the corner.

The Autumn Statement 2022 included reforms to the R&D tax relief scheme that will come into play from 1 April 2023. But what will these look like, and what should businesses and their R&D advisers be doing in preparation?

Changes relating to accounting periods beginning on or after 1 April 2023 (SME and RDEC)

Claims need to be more comprehensive

All claims will need to be accompanied by a detailed report outlining R&D activities and how they mirror HMRC legislation. This narrative will need to include evidence to support an R&D project’s scientific or technological advancement, with specific detail on the obstacles and uncertainties encountered and attempted to overcome, and a breakdown of qualifying costs. The report will also need to be submitted digitally. Advisers will have to put their name to the report, and all claims must be signed off by a senior officer at the claimant company.

Businesses need to notify HMRC in advance

From 1 April 2023, any company that has never submitted an R&D tax relief claim before must inform HMRC that they are considering a submission within six months from the end of the accounting period for which the claim relates. A business that has made a claim in the last three accounting periods does not need to notify in advance. A consequence of this new requirement is that new claimants will not be able to include the previous two closed tax years’ R&D projects within their first claim unless the necessary notification for the earlier period is made in time.

If the company notifies HMRC but does not make a claim, they are not penalised in any way but they will need to re-notify when they are ready.

The time period to actually make the claim remains at two years from the end of the accounting period.

There are still outstanding questions about how this notification process will actually work. We don’t yet know whether it can be submitted digitally, or even whether an adviser can send the notification on a client’s behalf. One obvious risk under the new rules is that businesses that do not get timely advice on claiming R&D tax relief could miss the deadline and lose out.

Changes relating to expenditure incurred on or after 1 April 2023

R&D rate changes

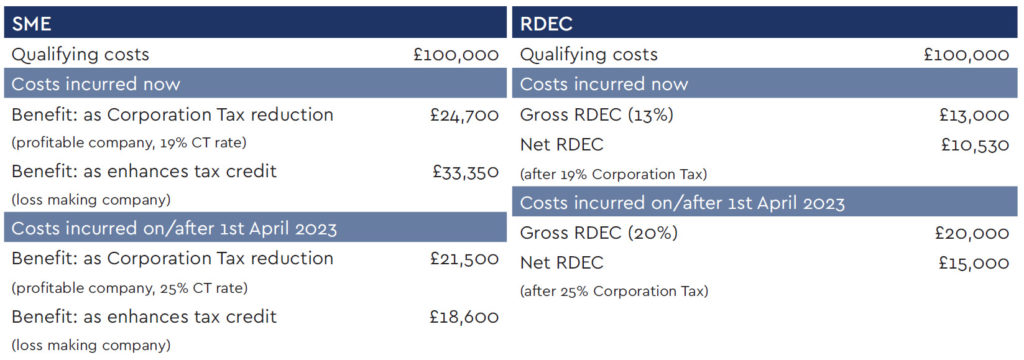

On a positive note, in the Autumn Statement Hunt reaffirmed the government’s commitment to increase

R&D spend to £20 billion by 2025.

He announced increased generosity to the Research and Development Expenditure Credit (RDEC),

whereby for expenditure on or after 1 April 2023, the RDEC rate is set to increase from 13% to 20%. This is

an after-tax increase from 10.53% to 16.2% for a company paying tax at 19% and an increase to 15% for a

company paying tax at 25%.

For small and medium-sized UK businesses utilising the SME scheme, with expenditure on or after 1 April

2023, the uplift rate on tax relief will fall from 130% to 86%, and the tax credit rate will drop from 14.5% to

10% for loss-making businesses.

All of this follows the recent increase in corporation tax for some companies (depending on the

company’s profit), therefore companies with profits in excess of £250,000 will see little impact.

Alongside the Chancellor announcing that the changes are to combat R&D fraud, we believe they are the

first step in bringing the two separate schemes into line as a single RDEC scheme.

All changes are for expenditure on or after 1 April 2023, so companies with accounting periods that

straddle this date will see a mixed claim of old and new rates.

Of course, it will be some time before we start making claims that are impacted by the change, the

earliest possible being any claims for a period ending 30 April 2023.

We have illustrated below how the rate changes will affect your business now and following the

corporation tax increase from April 2023:

Remind me — why is all this happening?

The background to all this is that HMRC is cracking down on abuse of the R&D tax relief scheme. They

estimate that £469million has been lost through error and fraud.

Changes to what is eligible

Many of the measures coming into effect for accounting periods beginning on or after 1 April 2023 are

linked to cracking down on abuse of the scheme, though there are some other changes around what is

eligible for relief.

1. Data & cloud computing costs

The legislation is being updated to allow for claims on data sets, and cloud computing costs for

accounting periods beginning on or after 1 April 2023.

Data claims can be made where a company buys data, purely for R&D, which has no resale value

or lasting value to the company. Businesses will also be able to claim on cloud computing services

and cloud storage costs specifically incurred for R&D.

Data and computing costs are only eligible when they relate to direct R&D support activities, and

so do not apply to finance or HR functions, for example.

2. Exclusion of R&D costs for activities taking place overseas

In an effort to refocus R&D tax relief towards innovation in the UK and encourage businesses

to undertake innovation and R&D here, for accounting periods from 1 April, subcontractor and

externally provided worker activities taking place overseas can no longer form part of an R&D

claim.

There are some exceptions, however. These occur if material factors — such as geography,

environment, population or other conditions — required for the project are not present in the UK.

For instance, in the case of deep ocean research. Another exception is when regulatory or legal

requirements mean activities must take place outside the UK, such as with clinical trials.

How can businesses prepare for the R&D tax reforms?

Businesses will need to continue compliance by maintaining robust record-keeping, keeping track of

costs relating to all projects – including R&D activities – any overseas activities, and confirming eligibility

under the new legislation. This will all be vital for when it comes to compiling the detailed technical

report accompanying the claim.

Overall, an increase in R&D investment is great news, which will certainly go a long way in placing

innovation at the heart of the UK’s economic recovery.

However, due to the lower benefit achievable for SMEs, this makes it more critical for genuine innovators

to use reputable advisors to optimise their tax relief claim, by ensuring they identify as much of the

qualifying R&D costs as can be supported by the guidance and legislation. This way, businesses can be

assured their R&D efforts are fully rewarded.

Our professional team of experts will continue to campaign for tighter regulations and to help shape the

future of the R&D incentive.

We also specialise in a variety of other areas of tax relief and innovation funding, including commercial

property tax relief, patent box and grants.

As always, if you have any questions, or would like to explore further opportunities, don’t hesitate to get

in touch with us.